Have you ever wondered how to keep your retirement savings secure when the economy takes a downturn? Many investors turn to gold IRAs as a potential safety net during recessions. But is this strategy really as secure as it sounds? In this post, we’ll break down the pros, cons, and smart strategies for investing in gold IRAs during uncertain economic times.

Why Gold IRAs Gain Attention During a Recession

When the stock market stumbles and economic fears rise, gold has a reputation for holding its value. That’s because gold is seen as a “safe haven” asset — something that retains or even increases its worth when traditional investments falter.

Here’s why gold IRAs become appealing during tough economic periods:

- Tangible Value: Unlike stocks or bonds, gold is a physical asset with intrinsic worth.

- Hedge Against Inflation: When currency values drop, gold often rises in value.

- Market Independence: Gold prices may fluctuate, but they don’t always follow the same pattern as stocks or real estate.

For investors nearing retirement — or those looking to diversify — gold IRAs offer a layer of protection against market volatility.

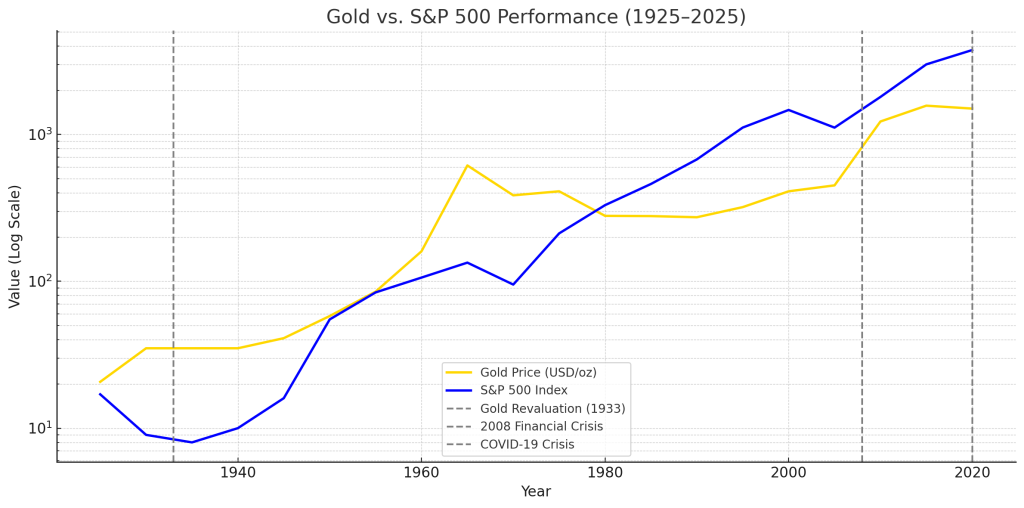

The Historical Performance of Gold in Economic Downturns

Gold’s track record during recessions has made it a popular fallback for cautious investors. While past performance doesn’t guarantee future results, history shows that gold has often held steady — or even surged — when other assets struggled.

For example:

- 2008 Financial Crisis: Gold prices spiked over 25% as global markets crashed.

- COVID-19 Market Shock: Gold prices soared in early 2020, reaching record highs while stocks plummeted.

This resilience makes gold IRAs an attractive option when economic uncertainty looms.

Pros and Cons of Investing in Gold IRAs During a Recession

While gold IRAs offer potential benefits, they also come with risks. Let’s break down both sides:

Pros:

✅ Wealth Protection: Gold’s value typically rises when other investments fall.

✅ Inflation Hedge: As the cost of living increases, gold often keeps pace.

✅ Diversification: Adding gold to your portfolio can reduce overall risk.

Cons:

❗ Price Volatility: Although gold is considered stable long-term, its price can swing significantly in the short term.

❗ Storage Costs: Gold must be securely stored in IRS-approved facilities, which adds fees.

❗ Limited Growth Potential: Unlike stocks or real estate, gold doesn’t generate dividends or passive income.

Key Factors That Influence Gold’s Value in Tough Times

Gold’s performance isn’t always predictable, even in recessions. These key factors often shape its value:

- Inflation Rates: Rising inflation typically boosts gold prices.

- Geopolitical Uncertainty: Wars, political instability, or trade tensions often drive investors toward gold.

- Market Sentiment: When confidence in traditional investments drops, gold demand rises.

Understanding these influences can help you make informed decisions about your gold IRA investments.

How to Safely Invest in a Gold IRA

If you’re considering adding gold to your retirement portfolio, here are some tips to minimize risk:

✅ Choose a Reputable Custodian: Select an IRS-approved custodian with solid reviews and a transparent fee structure.

✅ Diversify Your Holdings: Don’t go all-in on gold — balance it with other assets like stocks, bonds, or real estate.

✅ Monitor Gold’s Performance: Stay informed about gold market trends to make informed decisions about buying or selling.

✅ Understand IRS Rules: Gold IRAs have specific rules regarding eligible gold types and storage facilities — violating these can result in tax penalties.

Common Mistakes to Avoid When Investing in Gold IRAs

Investing in gold IRAs can be rewarding — but costly mistakes can reduce your gains. Here’s what to watch out for:

❌ Overconcentration in Gold: Relying too heavily on gold could leave you vulnerable if its value dips.

❌ Choosing the Wrong Custodian: Poorly managed custodians may impose excessive fees or fail to meet IRS regulations.

❌ Ignoring Storage Fees: Gold IRA storage fees can add up, so plan for these costs.

❌ Emotional Investing: Gold prices can fluctuate — avoid making rash decisions based on short-term spikes.

Alternatives to Gold IRAs for Recession-Proof Investing

If gold IRAs aren’t your ideal fit, consider these alternative investment options for protecting your wealth during a recession:

- Treasury Bonds: Government-backed and low-risk, these provide consistent returns.

- Dividend-Paying Stocks: Established companies with solid dividends often weather recessions better than growth stocks.

- Real Estate Investment Trusts (REITs): These can generate income even in slower markets.

- Commodities like Silver or Platinum: Diversifying with other precious metals can add additional stability.

Final Verdict: Are Gold IRAs a Safe Bet During a Recession?

So, are gold IRAs truly safe during a recession? While gold IRAs can provide a valuable hedge against inflation and economic instability, they’re not a one-size-fits-all solution. Balancing your portfolio with a mix of assets — including gold — can improve your chances of weathering a financial storm.

If you’re considering a gold IRA, the key is preparation. Understand the risks, plan for costs, and work with a trusted advisor to create a strategy that aligns with your retirement goals.

Thinking About a Gold IRA? Here’s Your Next Step

If you’d like expert guidance on starting a gold IRA or diversifying your investments, Get started by claiming a FREE gold IRA kit and get the basics. You can also call (877) 629-6108 and speak to a gold IRA specialist. Best of luck!