Gold has long been valued as a safe-haven asset, especially during times of economic instability. While stocks often plummet and real estate can face liquidity issues, gold has historically held or increased in value during financial crises. Its low correlation with equities makes it a powerful diversification tool, particularly when traditional markets falter.

The Great Depression (1929–1930s)

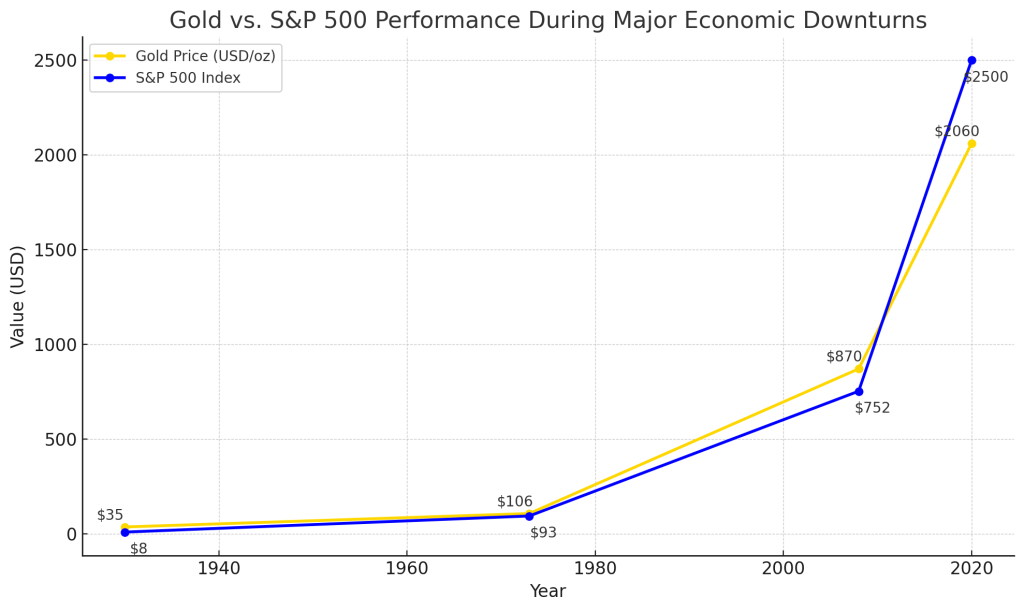

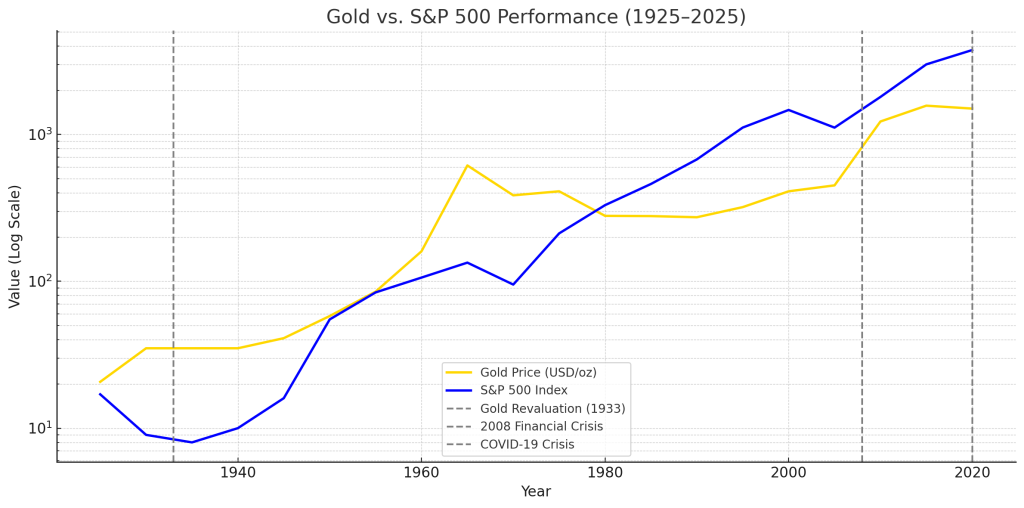

During the Great Depression, stock markets experienced devastating losses, with the Dow Jones Industrial Average plunging nearly 90% from its 1929 peak to its 1932 low. Meanwhile, gold retained its value because it was tied to the gold standard, which fixed its price at $20.67 per ounce.

In 1933, President Franklin D. Roosevelt revalued gold to $35 per ounce, effectively increasing its value by 69%. This sudden increase rewarded those who held gold, significantly enhancing its purchasing power. Gold mining stocks also flourished during this period, with Homestake Mining – one of the largest gold producers – rising over 500% during the Depression.

In contrast, real estate values dropped by roughly 30–35%, and widespread mortgage defaults created further instability. While government bonds provided some stability, gold stood out for its ability to maintain and even grow in value during a period of economic turmoil.

The 2008 Global Financial Crisis

The 2008 financial crisis saw major losses in equities and real estate. The S&P 500 dropped roughly 50% from its late-2007 peak to its 2009 low. Real estate, which was at the heart of the crisis, experienced steep declines as U.S. home prices fell around 30–35%.

During this period, gold prices rose approximately 25%, standing out as one of the few assets to deliver gains. Even in 2008, a year when the stock market fell 36%, gold managed to finish the year with a modest gain of about 4%. Meanwhile, U.S. Treasury bonds also surged as investors sought low-risk assets.

While gold experienced some volatility during the height of the panic — briefly falling around 25% as investors sold assets to raise cash — it rebounded quickly. By 2011, gold had surged to new highs above $1,900 per ounce as demand for safe-haven assets intensified.

The COVID-19 Downturn (2020)

The COVID-19 pandemic triggered one of the fastest economic contractions in history. In early 2020, the S&P 500 fell 34% in just over a month as global markets panicked. Initially, gold prices also dropped by roughly 12% as investors scrambled for liquidity.

However, gold quickly recovered and soared to a record high of around $2,070 per ounce by August 2020. By the end of the year, gold had gained roughly 24–25%, outperforming both equities and bonds.

While U.S. Treasuries also delivered positive returns in 2020, gold’s rapid recovery and new record highs cemented its role as a reliable hedge. Real estate fared better than in previous crises, with home prices rising approximately 10% by year-end, thanks to low mortgage rates and increased demand for housing.

Gold vs. Stocks, Bonds, and Real Estate: Performance and Volatility Comparison

- 1930 (Great Depression) – Gold retained its value while the stock market plummeted.

- 1973 (Oil Crisis & Stagflation) – Gold surged significantly as inflation spiked, while the stock market struggled.

- 2008 (Global Financial Crisis) – Gold rose steadily, providing a safe haven while the S&P 500 dropped sharply.

- 2020 (COVID-19 Crisis) – Gold soared to record highs as uncertainty gripped global markets.

Gold has consistently delivered positive returns during major economic downturns. During the Great Depression, gold’s purchasing power surged after its revaluation. In the 2008 crisis, gold delivered solid gains while stocks and real estate plummeted. In the COVID-19 downturn, gold again outperformed most asset classes, achieving record highs even as markets remained unstable.

In terms of volatility, gold tends to be more stable than equities in times of crisis. While stocks can suffer sharp losses and take years to recover, gold’s price movements are often less extreme, and its recovery is typically faster. Although gold can experience brief sell-offs during liquidity crunches, it has repeatedly rebounded quickly and delivered strong performance throughout crisis periods.

Investor behavior consistently shows a flight to safety in turbulent times. During financial crises, gold attracts strong demand as investors shift away from equities and other riskier assets. Gold’s ability to preserve value, combined with its reputation as an inflation hedge, makes it particularly appealing when economic uncertainty is high.

Can Gold Protect Your Portfolio During Economic Downturns?

Gold has repeatedly demonstrated its value as a safe-haven asset during economic downturns. From the Great Depression to the 2008 Financial Crisis and the COVID-19 pandemic, gold has consistently preserved capital and delivered gains while stocks and real estate struggled.

While gold’s price can experience short-term dips during market panics, its track record shows a strong ability to recover and thrive during prolonged instability. As part of a well-diversified portfolio, gold plays a crucial role in protecting wealth and mitigating risk during periods of economic uncertainty.